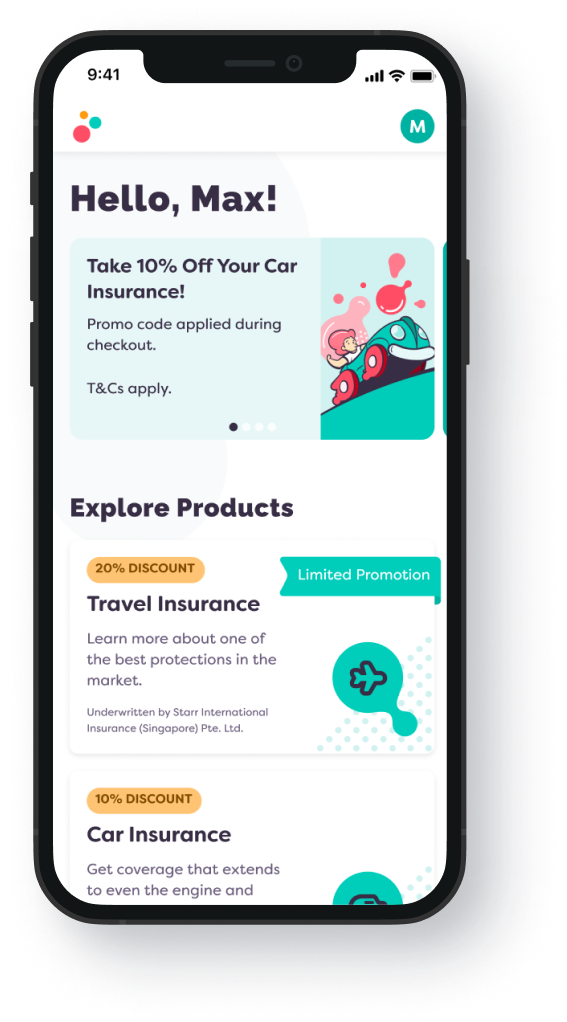

Insurance can be

affordable.

Bubblegum's got you covered with the best bang-for-buck products.

Choose your product

Reasons to love

Bubblegum

No frills, just value

We offer essential coverage at the lowest prices possible.

Live access to a support team

Choosing insurance can be hard. Our support team is here to help you figure things out.

Quick, easy & convenient

Browse our products & buy a policy in minutes. Do it online or in-app.

Policies at your fingertips

Create an account and get access to your policy documents & coverage details anytime.